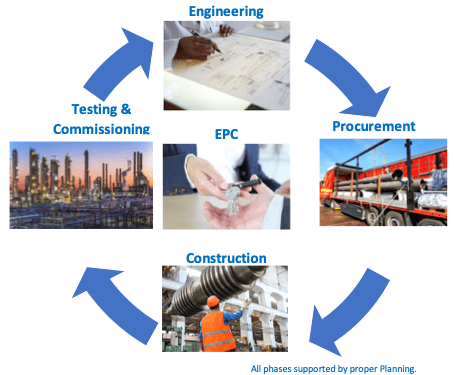

What are EPC contracts?

Under an EPC contract, the principal or owner engages a contractor to design and deliver the project into an operational state. This type of contract is at times described as a ’turnkey’ contract as, at completion of the project, the Principal can simply ’turn a key’ to start operation.

Features of EPC contracts

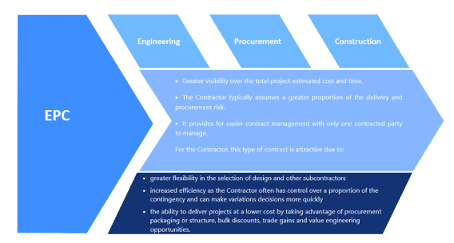

The primary feature of an EPC contract is its single point of responsibility whereby the Principal engages with only one contractor. The EPC contractor (the Contractor) will then manage all the subcontractor relationships on behalf of the Principal.

The structure benefits the Principal in the following ways.

- Clearly defined project scope – to minimise the risk of time and cost overrun, it is important the Principal clearly defines the output, or deliverable, and the expected standards, but not the construction methodology or the suppliers (subcontractors). If the Principal specifies either the construction methodology or the suppliers, it will reduce the cost saving opportunities for the EPC and increase the likelihood of variations claims should those subcontractors fail.

- Variations clauses – where the Principal has the ability to instruct changes or variations with an agreed-upon method for calculation of the additional cost, e.g. agreed rates for variation work, this can provide greater control over the outcome, and can help to keep the costs of variations under control. Variation cost estimates should ideally be reviewed by an independent Quantity Surveyor to ensure these remain competitive.

- Project milestones – the Contractor should be required to provide monthly raw data schedule files, schedule quality review scores (e.g. Acumen Fuse scores), as well as regular Schedule Risk Analyses (SRA). This will help to ensure that schedule reporting remains accurate and the Contractor schedule can be trusted.

- Counterparty review – counterparty default risk can be mitigated through a counterparty review of the Contractor (financials and non-financials, e.g. governance and controls) both prior to execution of the EPC contract, and at key points through the project lifecycle (e.g. through the use of project health checks).

Key risks in relation to EPC contracts

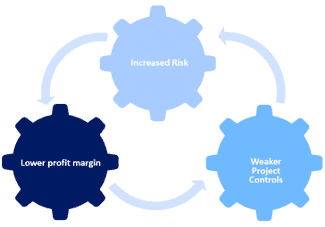

1. The relationship between low profit margin and weak project controls

One of the main risks to the Principal in an EPC contract is the risk of default by the Contractor. Two key factors that contribute to an increased default risk are a low profit margin and weak project controls.

The overall construction sector continues to operate in a thin margin environment due to higher input costs and fierce competition. To combat this, some contractors have invested in innovation and new technology such as drones and Building Information Modelling (BIM) that were intended to increase efficiency.

As a flow-on from thin profit margins, we have observed that many industry players have not adequately invested in upgrading their accounting and financial project control systems to accommodate for the more complex and high risk EPC projects.

Furthermore, INGENIVA has observed the importance of dedicated full-time Commercial and Contract Management Professionals who are experienced in managing contract variations.

However, in order to minimize costs, there have been instances where contractors delegate this role to. This often results in weaker project control and increased project risk exposure, continuing the cycle illustrated in the diagram below.

Weak governance and soft controls

Good governance, including hard and soft controls are important success factors on construction projects. Weak governance – such as a lack of ownership and accountability – increases the risk of project failure.

It is INGENIVA’s observation that soft controls like role modelling and achievability are as important in projects as the more recognised hard controls, like systems and processes.

An example of a weak soft controls environment is one where there is a culture of avoiding the communication of ‘bad news’ to senior management, despite there being a robust reporting process in place. This often results in senior management lacking awareness of the true status of their projects, and is exacerbated by inadequate second and third line assurance activity. Altogether this results in a failure to identify and solve issues in a timely manner, and ultimately, to project failure.

Ingeniva have reviewed some of these project failures and can draw the following lessons for EPC contractors:

- Invest in project controls, commercial and contract management professionals and ensure that they are dedicated to the project – and on site – full time.

- Implement programs to attract and retain highly-skilled and diverse resources.

- Establish and maintain an appropriate baseline of training in core project management skills.

- Invest in a culture of innovation and in technologies aimed at improving project controls and project delivery efficiency.

- Ensure an uplift in the maturity and effectiveness of project controls by implementing a project assurance framework. This should include independent project health checks.

- Understand that hard controls are only part of the picture. Soft controls such as role modelling and achievability can be equally important to achieving project outcomes.

- Invest in risk management training with a view to creating an organisation-wide culture of risk awareness.

- Awareness and good communication through out department can be key to successfully completing and EPC project.

3. Inappropriate risk allocation

It is rarely appropriate for the Contractor to assume ownership of all the risks. A ‘good’ EPC contract is one that assigns risks to the party best placed and best qualified to manage that risk.

From researching recent contractor defaults, a common factor in these defaults has been the assumption of risks by the Contractor that they were not resourced or equipped to manage. The Principal should ensure that the Contractor has both skills and capacity to manage the identified risks, and the balance sheet capacity to absorb any additional ‘unknown’ risks that may arise. This applies particularly for larger, more complex, and EPC projects.

By identifing any potential risk and bring it to risk matrix, after giving scores for probibility of acuuring and it’s impact on the project, we could prevent or mitigate the potential risks effects through a response plan.

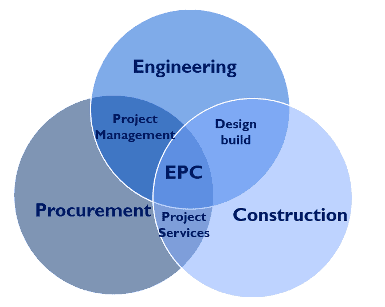

A further identifying feature of the EPC contract is that the EPC contractor enters into separate agreements with the contractors, vendors, sub-contractors, sub-vendors and so on. This is advantageous to the owner or principal of the project, as they will look to the EPC contractor to take full responsibility for the project and, in the event of a dispute between the EPC contractor and any party to the sub-agreements, to resolve the dispute without the owner or principal being required to be a party to the dispute. The EPC contractor will, in most cases, have a right of recourse against a party to a sub-agreement who was responsible for causing the loss or damage. The EPC contractor must ensure that its contracts mirror those that it has with the owner of principal.

The key clauses in any construction contract are those which impact on:

- Time

- Cost

- Quality

The same is true of EPC contracts. However, EPC contracts tend to deal with issues with greater sophistication than other types of construction contracts. This is because, as mentioned above, an EPC contract is designed to satisfy the lenders’ requirements for bankability. EPC contracts provide for:

- A single point of responsibility

The contractor is responsible for all design, engineering, procurement, construction, commissioning and testing activities. Therefore, if any problems occur the project company need only look to one party – the contractor – to both fix the problem and provide compensation.

As a result, if the contractor is a consortium comprising several entities the EPC contract must state that those entities are jointly and severally liable to the project company.

- A fixed contract price

Risk of cost overruns and the benefit of any cost savings are to the contractor’s account. The contractor usually has a limited ability to claim additional money which is limited to circumstances where the project company has delayed the contractor or has ordered variations to the works.

- A fixed completion date

EPC contracts include a guaranteed completion date that is either a fixed date or a fixed period after the commencement of the EPC contract. If this date is not met the contractor is liable for delay liquidated damages (DLDs).

To be enforceable in common law jurisdictions, DLDs must be a genuine pre-estimate of the loss or damage that the project company will suffer if the project is not completed by the target completion date.

The genuine pre-estimate is determined by reference to the time the contract was entered into. DLDs are usually expressed as a rate per day which represents the estimated extra costs incurred (such as extra insurance, supervision fees and financing charges) and losses suffered (revenue forgone) for each day of delay.

- Performance guarantees

The project company’s revenue will be earned by operating the project. Therefore, it is vital that the project performs as required in terms of output, efficiency and reliability.

Therefore, EPC contracts contain performance guarantees backed by performance liquidated damages (PLDs) payable by the contractor if it fails to meet the performance guarantees.

As with DLDs, the genuine pre-estimate is determined by reference to the time the contract was signed. PLDs are usually a net present value (NPV) (less expenses) calculation of the revenue forgone over the life of the project.

For example, if the output of a power plant is five MW less than the specification the PLDs are designed to compensate the project company for the revenue forgone over the life of the project by being unable to sell that five MW.

- Caps on liability

As mentioned above most EPC contractors will not, as a matter of company policy, enter into contracts with unlimited liability. Therefore, EPC contracts for power projects cap the contractor’s liability at a percentage of the contract price.

This varies from project to project, however, an overall liability cap of 100 percent of the contract price is common. In addition, there are normally sub-caps on the contractor’s liquidated damages liability.

- Security

It is standard for the contractor to provide performance security to protect the project company if the contractor does not comply with its obligations under the EPC contract. The security takes a number of forms including:

- A bank guarantee for a percentage

- Retention ie withholding a percentage

- Advance payment guarantee

- A parent company guarantee

- Variations

The project company has the right to order variations and agree to variations suggested by the contractor. If the project company wants the right to omit works either in their entirety or to be able to engage a different contractor this must be stated specifically.

- Defects liability

The contractor is usually obliged to repair defects that occur in the 12 to 24 months following completion of the performance testing. Defects liability clauses can be tiered. That is the clause can provide for one period for the entire power station and a second, extended period, for more critical items.

- Intellectual property

The contractor warrants that it has rights to all the intellectual property used in the execution of the works and indemnifies the project company if any third parties’ intellectual property rights are infringed.

- Force majeure

The parties are excused from performing their obligations if a force majeure event occurs. This is discussed in more detail below.

- Suspension

The project company usually has right to suspend the works.

- Termination

This sets out the contractual termination rights of both parties. The contractor usually has very limited contractual termination rights. These rights are limited to the right to terminate for non-payment or for prolonged suspension or prolonged force majeure and will be further limited by the tripartite or direct agreement between the project company, the lenders and the contractor.

Recent Comments